Table of Contents

Bitcoin ETF- The swift critiques from the U.S. Securities and Exchange Commission (SEC) following the submission of revised fee disclosures for spot Bitcoin exchange-traded fund (ETF) issuers have fueled speculation within the crypto community. There are now concerns about a potential delay in the much-anticipated approvals of the Bitcoin ETFs.

🚨SPOT BITCOIN ETF UPDATE: The SEC just issued additional comments on pending applicant's S-1s. This is a delay signal.🚫 #BitcoinETF #bitcoin

— Perianne (@PerianneDC) January 9, 2024

Chamber of Digital Commerce CEO Perianne Boring emphasized the potential significance of the U.S. Securities and Exchange Commission’s (SEC) issuance of additional comments on pending spot Bitcoin ETF applicants’ S-1s, stating, “This is a delay signal.”

Interpreting SEC Comments on Spot Bitcoin ETFs: Insights from Analyst James Seyffart

Despite concerns and speculation among crypto investors following the Chamber of Digital Commerce’s CEO’s comment on the potential delay signal, Bloomberg Intelligence ETF analyst James Seyffart offered a contrasting perspective.

Seyffart expressed that he does not see this as necessarily indicating a delay. He highlighted the quick turnaround time, stating, “Really this just shows how quickly the SEC is turning these things around.” Seyffart emphasized that it is borderline unheard of to submit a document in the morning and receive comments back from the SEC on the same day, suggesting that if a delay was intended, the issuers wouldn’t have received comments back so promptly.

Really this just shows how quickly the SEC is turning these things around. Borderline unheard of to send over a document to the SEC in the morning and get comments back the same day (I think)

— James Seyffart (@JSeyff) January 9, 2024

If they wanted to delay — the issuers wouldn't have gotten comments back tonight

Despite the submitted revisions being in the form of S-1 documents, it is important to note that the SEC does not necessarily require them to be approved before the 19b-4 spot Bitcoin ETF application forms. Finance lawyer Scott Johnsson emphasized this point, stating that S-1s do not need to be complete when 19b-4s are approved. He cited the example of futures ETFs in 2022, where Hashdex received initial comments only after its 19b-4 was approved.

Johnsson further highlighted that the swift comments from the SEC indicate a proactive effort to expedite the approval process and launch, in contrast to the timeline observed with futures ETFs. This suggests a concerted effort by the SEC to streamline procedures for a quicker approval and subsequent launch.

Fox Business journalist Eleanor Terrett corroborated this information with her sources, confirming that those who received additional comments are not expressing concern. According to Terrett, the SEC has conveyed no intention to deviate from the established schedule. This assurance from reliable sources adds further confidence to the notion that the SEC is actively working to maintain the current timeline for the spot Bitcoin ETF application forms.

Just spoke with a couple of people who received additional comments. They say they’re not worried and the @SECGov hasn’t conveyed a change of plans.

— Eleanor Terrett (@EleanorTerrett) January 9, 2024

My sense is that they’re fairly confident this is just part of the process to get everything in before January 10th. https://t.co/B9PvuHo6yX

Issuers Disclose Fees in S-1 Forms

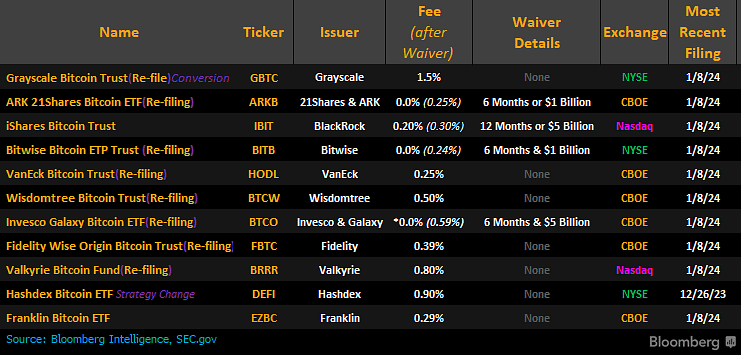

Additionally, the recently revealed S-1 forms showcase a notable divergence in fees among Bitcoin ETF issuers. Bitwise has set a competitive tone with a fee of 0.24%, slightly undercutting VanEck and ARK Invest, both of which propose a marginally higher fee of 0.25%.

In a distinctive move, Invesco stands out by offering a fee waiver, reducing its initially stated fee from 0.59% to zero for the first six months, potentially attracting investors with a temporary cost advantage.

Despite Grayscale’s Bitcoin Trust (GBTC) sporting the highest fee among the issuers at 1.5%, its impressive trading volume on January 8th, exceeding close to half a billion dollars, sets it apart by outperforming a significant portion of ETFs in the market.

For any queries and suggestions contact us here.